Bitget CEO Gracy Chen has warned that the long-anticipated altcoin season is unlikely to arrive in 2025 or even 2026, signaling a dramatic shift in overall crypto market sentiment.

Liquidity, momentum, and institutional focus have increasingly shifted from these alternative cryptocurrencies, leaving them with limited investor attention and weaker price action. The message is clear: the golden era of altcoin speculation appears to be on pause—if not over entirely.

Sponsored

Sponsored

Is the Altcoin Season Over for Good?

In a recent post on X (formerly Twitter), Chen stated that altcoins are “fading.” She explained that the “Black Swan” event on October 11 inflicted severe damage on the altcoin market. It worsened an already fragile environment where VC funding in early-stage Web3 projects had been drying up for over a year.

“Retail investors trading altcoins face a terrible risk-reward ratio. Let’s be real—the alt season will not come in 2025 or 26,” Chen wrote.

Chen added that large capital has become increasingly risk-averse, reflecting the broader caution in the market. She pointed out that weekly trading volume across centralized exchanges (CEXs) has fallen by 20–40%, while several major market makers suffered liquidations after overleveraging.

The Bitget CEO described the current stage as the “doubt” phase of the market cycle. This sentiment is reflected in the Crypto Fear and Greed Index, which stands at 30 during press time.

She emphasized that the market now needs time to recover and that traders should proceed with discipline. According to her, only a handful of projects tied to real-world use cases, such as stablecoins, real-world assets (RWA), and payment infrastructure, may still stand out.

Sponsored

Sponsored

However, Chen noted that many of these projects are unlikely to issue tokens, further reducing opportunities in the altcoin space.

Bitcoin Season Is Back — and Altcoins May Not Recover Anytime Soon

The shift Chen described isn’t just sentiment—it’s showing up in the numbers. 10x Research recently reported that momentum has firmly moved toward Bitcoin, while altcoins face declining liquidity.

“Altcoins have underperformed Bitcoin by an astonishing $800 billion this cycle — and retail investors are the ones left behind. While social media continues to promise the next ‘alt season,’ the data tells a different story,” the post read.

The market intelligence firm added that even Korean retail traders, once known for driving altcoin speculation, are redirecting their focus toward crypto-related equities. Previously, BeInCrypto also pointed out that crypto-related stocks have gained substantially this year, even outpacing BTC.

“Liquidity, momentum, and conviction have all migrated elsewhere, leaving the altcoin market eerily quiet. Meanwhile, institutions are shaping this cycle in ways few expected — and retail may not yet realize what that means,” 10x Research added.

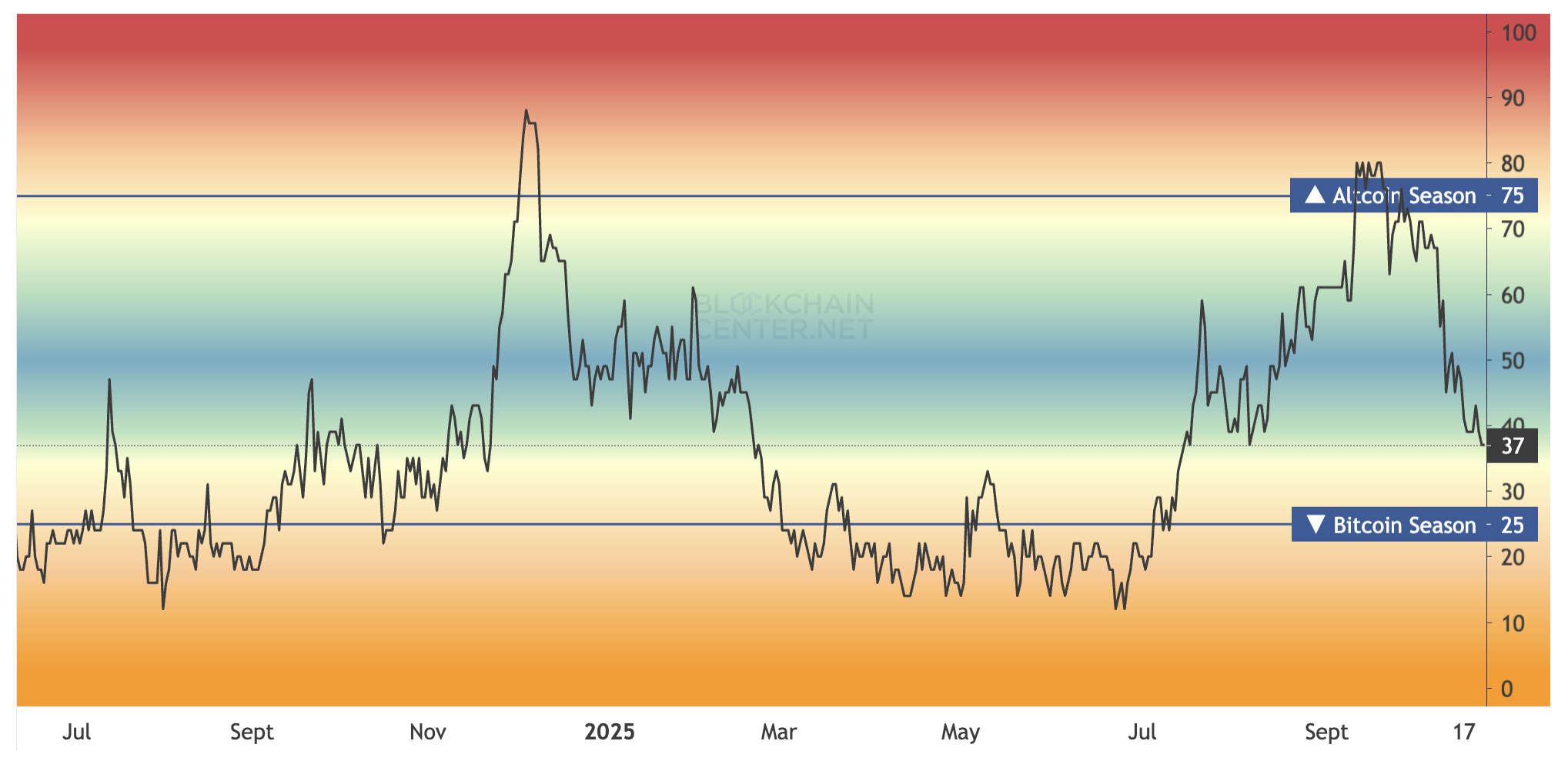

Market indicators corroborate this downturn. The Altcoin Season Index, which measures whether 75% of the top 50 non-stablecoins outperform Bitcoin over 90 days, has plummeted to 37. This marked its lowest point since mid-July, firmly entrenching a “Bitcoin Season.”

In addition, the sudden decline in altcoin narrative discussions in October reflected a growing sense of fatigue. Taken together, these signals paint a bleak picture for a potential altcoin rally.