The third quarter of 2025 was a significant one, posting substantial achievements, according to the latest crypto industry report by crypto data aggregator CoinGecko. Yet, despite Bitcoin (BTC)’s surge to a fresh ATH, major altcoins – particularly Ethereum (ETH) – strongly outperformed.

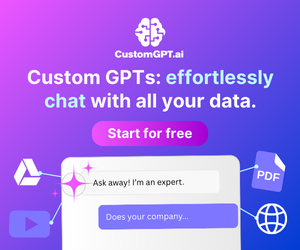

The crypto market recorded its third consecutive rallying quarter in Q3 this year. This is also the second consecutive quarter of “significant capital appreciation,” the report noted.

Moreover, it was the market’s second leg of recovery, powered by liquidity, a sharp recovery of trading activity, and renewed institutional inflows.

The total market capitalization increased by 16.4% with $563.6 billion, hitting the $4 trillion mark. Notably, this is the highest level since late 2021.

Moreover, the average daily trading volume saw “a decisive reversal” in Q3, suggesting higher market participation. It went up nearly 44% from Q2 to $155 billion, following two consecutive quarters (Q1 and Q2) of diminishing spot activity.

At the same time, Bitcoin dominance noted a significant shift, dropping to 56.9%. This signaled “a material rotation into ETH and other large-cap altcoins” and “a material shift from the ‘flight to quality’ trend seen earlier in the year,” CoinGecko noted.

The main beneficiary was Ethereum, as will be discussed below. Its market share rose to 12.5%, showing a renewed interest and capital inflows into ETH.

Other major altcoins benefited as well, including XRP (+0.5 percentage points), BNB (+0.7 p.p.), and SOL (+0.4 p.p.).

Altcoins In Focus, Bitcoin Lagging

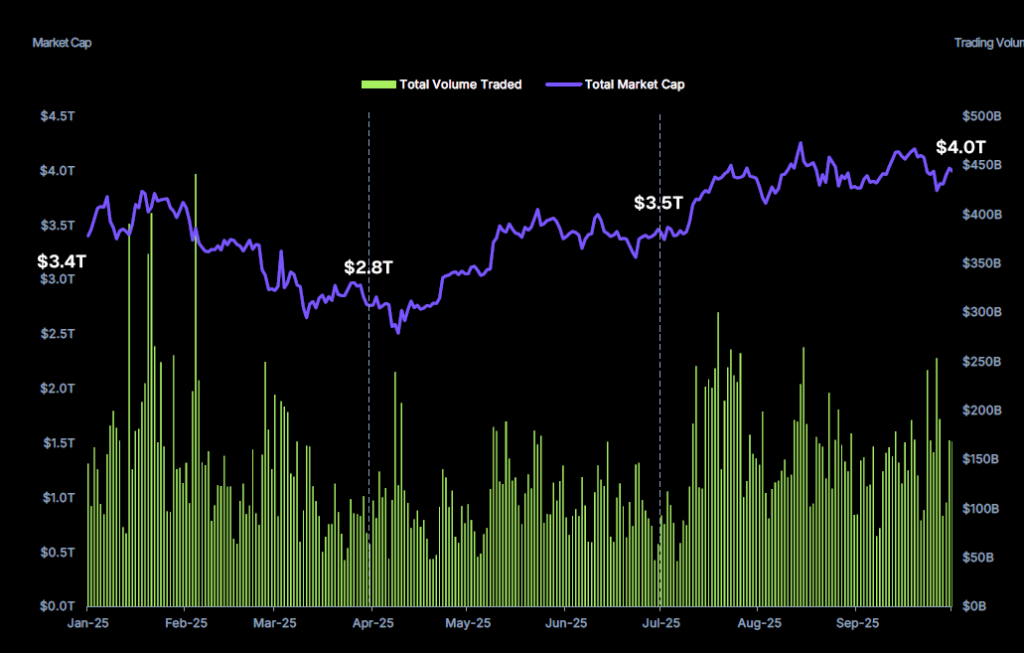

Altcoins strongly outperformed in Q3 this year, CoinGecko highlighted. BTC was “the notable laggard” in the top 5 coins category, with a 6.4% appreciation.

At the same time, ETH led the list with a 66.6% rise, outperforming major altcoins and even hitting a new all-time high of nearly $5,000.

Notably, there was a clear renewed interest in ETH, fueled by strong net inflows into US Spot ETH exchange-traded funds (ETFs) and institutional buy pressure from treasury companies such as Tom Lee’s Bitmine Immersion and Joe Lubin’s SharpLink.

At the same time, BNB went up 53.6%, SOL 34.7%, and XRP 27%. BNB exploded in Q3, also hitting an ATH, powered by closer integration with Binance via Binance Alpha and the perp DEX Aster success, says the report.

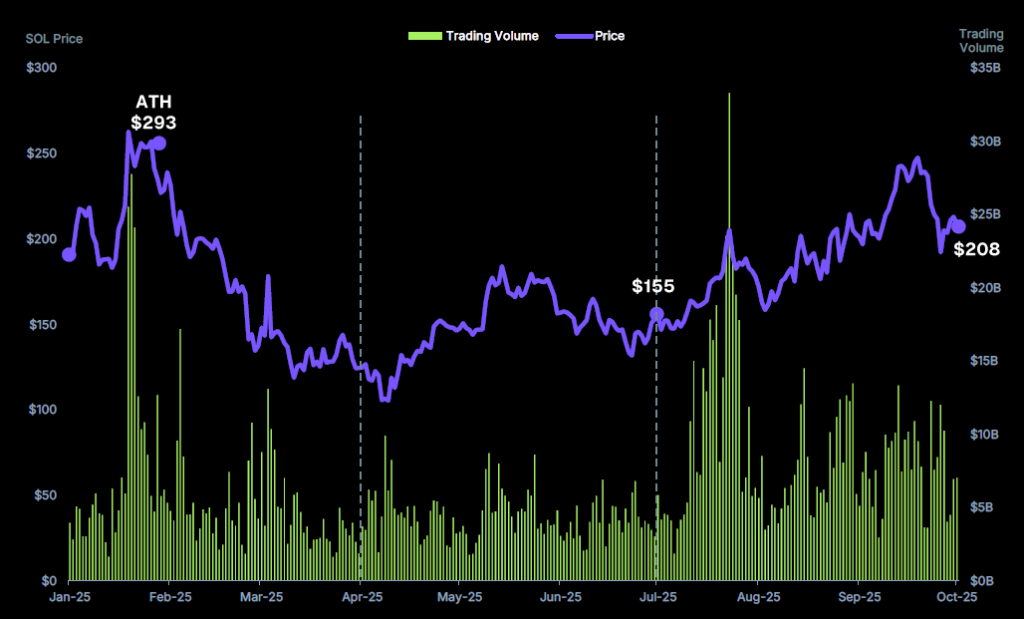

Also, SOL reached a quarterly high of $248 with an influx of treasury companies. However, it lost momentum amidst a late-September market pullback and ETF approval delay.

Speaking of ETFs…

CoinGecko highlighted that BTC’s early surge followed continuous retail and institutional accumulation, particularly through Bitcoin ETFs.

However, analysts also noted a reversal of the inflow trend at the end of September. US spot BTC ETFs recorded outflows amidst a general market decline.

US Spot BTC ETFs net inflows decreased from $12.8 billion in Q2 to $8.8 billion in Q3. Total AUM grew by 16% from $143.4 billion to $166.3 billion.

At the same time, US spot ETH ETFs noted $9.6 billion in net inflows. This was “by far the largest quarter and the first time it has surpassed BTC ETFs,” the report says. Total AUM reached $28.6 billion, marking a 177.4% jump quarter-on-quarter.

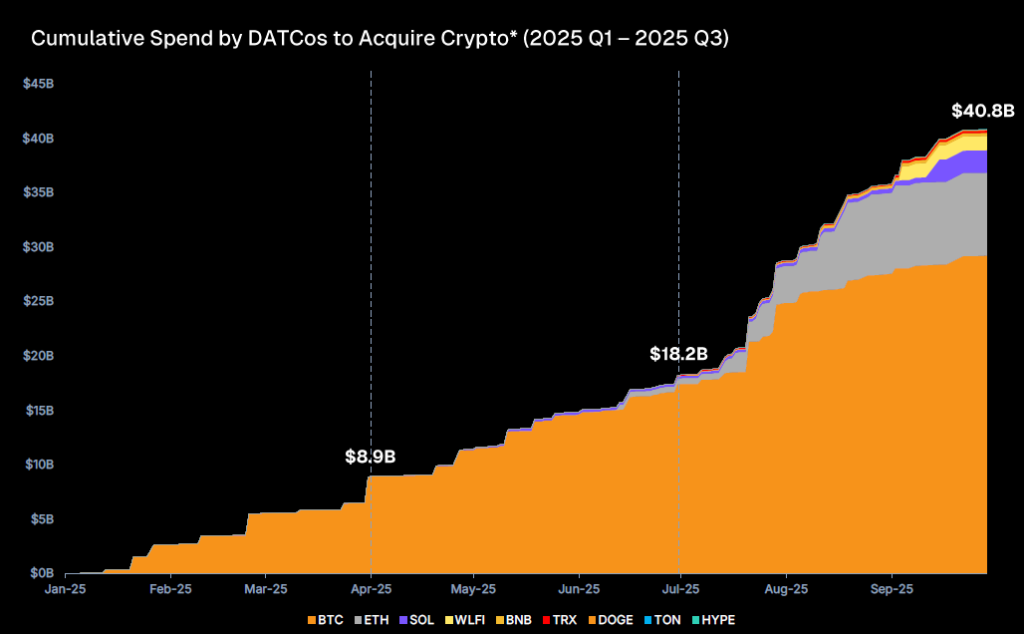

Moreover, crypto digital asset treasury companies (DATCos) spent at least $22.6 billion in new crypto acquisitions in Q3. This was “by far the largest quarterly amount thus far.” Of this, altcoin DATCos accounted for $10.8 billion (47.8%).

Overall, DATCos held some $138.2 billion worth of crypto by the end of Q3.

Strategy dominated with >50% share, while two ETH DATCos made the top 5 list (Bitmine Immersion and Sharplink).

Stablecoin Market Cap Hits New ATH

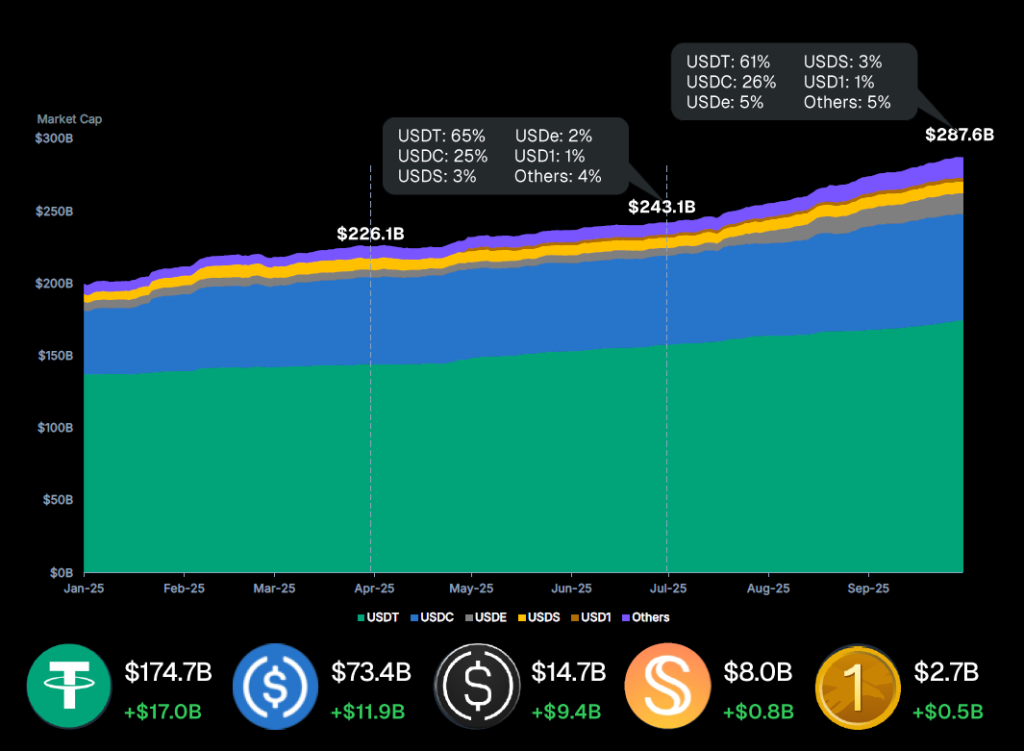

In the previous quarter, the top 20 stablecoin market cap surged by over 18%, with $44.5 billion, reaching a new ATH of $287.6 billion.

Top gainers are:

- Ethena’s USDe: jumped by 177.8% or $9.4 billion in market cap, with the market share growing from 2% to 5%, overtaking USDS as the third-largest stablecoin.

- Tether’s USDT: saw the largest absolute increase, adding $17 billion to its market cap, while its market share fell from 65% to 61% due to the accelerated growth of other stablecoins.

The market cap has continued to climb in early Q4, surpassing $300 billion. At the time of writing in late October, it stands at $312 billion, per CoinGecko.

DeFi Surges

DeFi Total Value Locked (TVL) was up 40.2% from $115 billion at the start of July to $161 billion at the end of September. ETH’s “outsized appreciation and the ongoing stablecoin narrative” fueled this surge, CoinGecko says.

Moreover, the DeFi sector’s market cap climbed to $133 billion shortly after ETH hit $3,000 in mid-July. In late September, it hit the Q3 peak of $181 billion following a price jump of newly launched tokens from perpetual DEXes such as Avantis (AVNT) and Aster (ASTER).

DeFi’s market share increased from 3.3% in Q2 to 4% in Q3 2025.

CEX and DEX

In Q3, the top centralized exchanges (CEXes) recorded $5.1 trillion in spot trading volume. This is a nearly 32% increase from Q2’s $3.9 trillion.

- Upbit was the largest gainer, rising +40.5%, climbing to #9.

- Bybit rose by 38.4%, moving from #6 to #3. Its monthly average volume moved above $120 billion, the level last seen in February before the hack.

- Binance’s trading volume grew 40 QoQ for a cumulative $2.06 billion. Its market share increased slightly to 40%.

- Coinbase ranked #10 globally. Its volume rose by 23.4% but was still “outpaced by its rivals.”

Meanwhile, the trading volume of the top 10 perpetual decentralized exchanges grew by +87% from $964.5 billion in Q2 to $1.81 trillion in Q3.

Aster, Lighter, and edgeX are challenging Hyperliquid for the position of the largest Perp DEX. The latter had a 54.6% market share in Q3.

“From an OI perspective, Hyperliquid still retains a sizeable lead amongst perp DEXes, with 75% share of OI as at October 1. No other competitor had

Trending News

RecommendedPopular Crypto TopicsPrice Predictions