The cryptocurrency market witnessed an explosive rally among many altcoins in the previous month. Massive capital inflows pushed the total altcoin market capitalization (TOTAL2) to a new all-time high above $1.7 trillion. However, within just the first three weeks of October, more than $300 billion in value has been wiped out.

As a result, several major altcoins are now facing profit-taking pressure from investors, reflected in their rising supply on exchanges. Which altcoins are under the most pressure?

Sponsored

1. Chainlink (LINK)

Chainlink (LINK) delivered an impressive performance in Q3 2025, reaching over $28 in August, while its exchange reserves continued to hit new lows. However, data from Santiment shows that LINK’s exchange supply has started to reverse in October.

Over the past seven days, LINK’s exchange supply increased from 171 million to 182 million tokens. A positive market environment could signal a healthy redistribution to new investors.

But in the current climate of extreme fear, the growing supply on exchanges may quickly become heavy selling pressure.

Market sentiment now outweighs positive internal developments. Despite S&P Global’s new initiative to use Chainlink for a stablecoin project, LINK’s price has dropped by more than 27% since the start of the month.

Sponsored

2. XRP

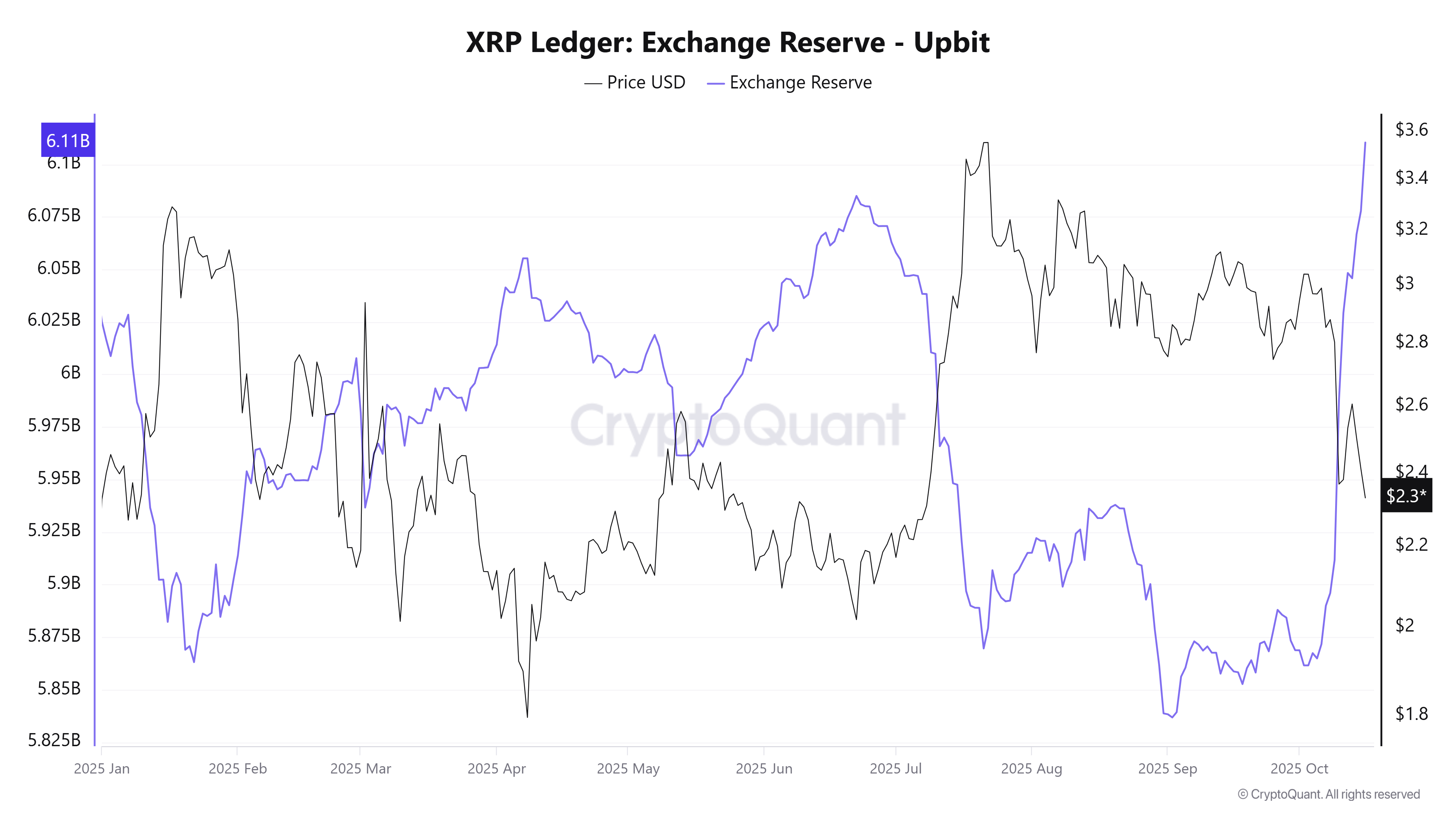

According to Coingecko, XRP trading volume accounts for over 16% of liquidity on Upbit, showing the strong interest of Korean investors in this token.

For that reason, the level of XRP reserves on Upbit serves as a useful indicator of investor sentiment. Data from CryptoQuant reveals a clear inverse correlation throughout the year — when XRP reserves on the exchange increase, its price tends to fall, and vice versa.

Sponsored

In October, Upbit’s XRP reserves surged to their highest level since 2025, exceeding 6.1 billion XRP. This could indicate that selling activity among Asian investors may trigger broader sell-offs across other exchanges.

A recent BeInCrypto report also noted that on-chain data shows whales, smart money, and long-term holders reducing exposure to XRP, suggesting more downside risk in the coming days.

3. Aster (ASTER)

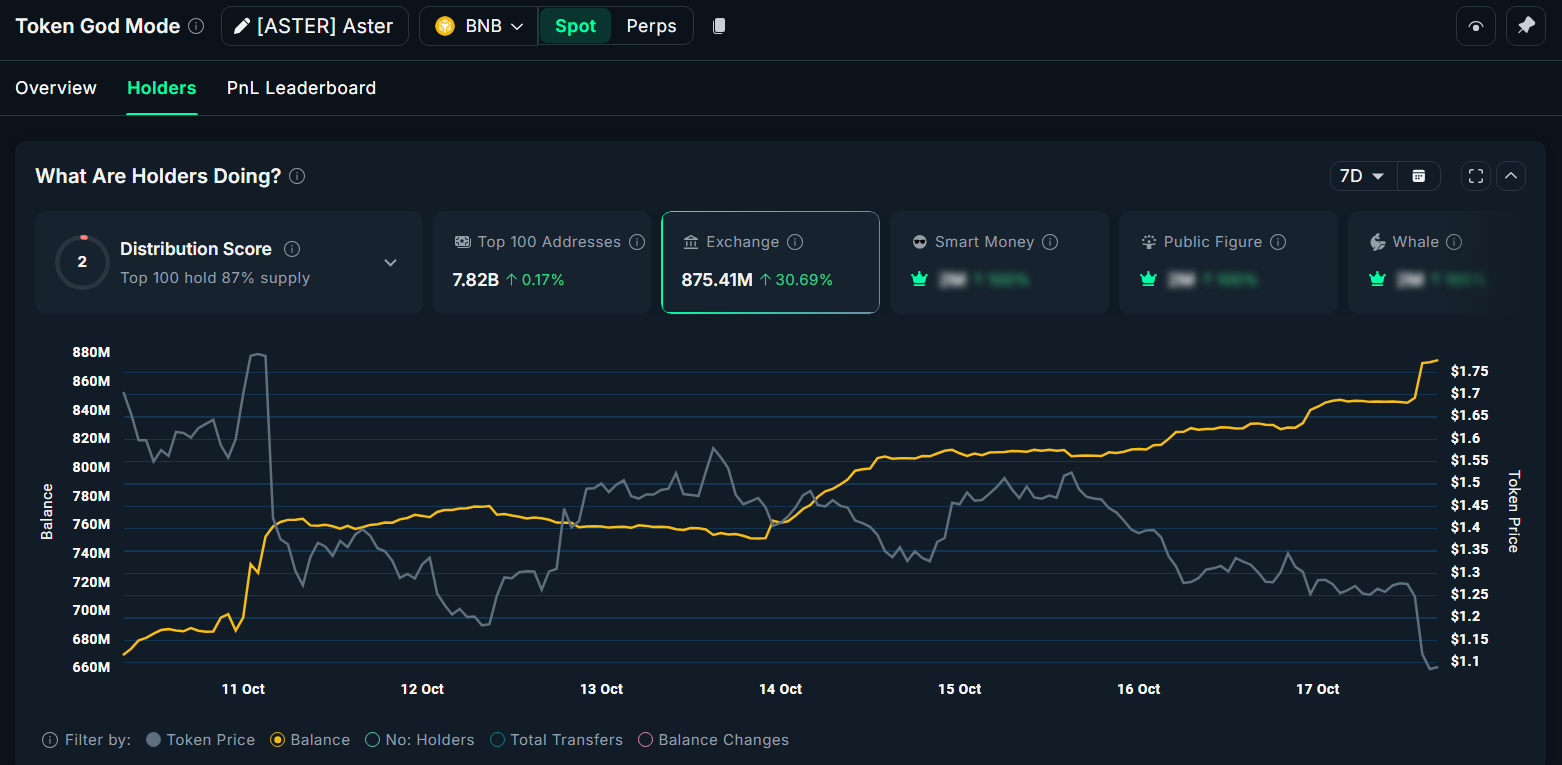

Data from Nansen shows that Aster (ASTER) has seen a sharp increase in exchange supply, climbing from around 670 million to over 875 million tokens in the past week — a more than 30% rise.

Sponsored

Alongside this increase, the price of ASTER dropped 50%, falling close to $1.1. This suggests that investors actively transfer tokens to exchanges for selling, creating further downward pressure.

These developments may indicate a cooling-off period for Perps DEX-related coins, which were heavily discussed last month. Artemis reported that Aster DEX’s daily perpetual trading volume has fallen from around $100 billion to $10 billion — a 90% drop.

The pessimistic sentiment is so strong that even Robinhood’s listing of Aster failed to stop its decline.

The simultaneous price drops and exchange supply surges in these three altcoins could signal the start of a capital rotation away from altcoins in October.